By Kadiri Abdulrahman, News Agency of Nigeria (NAN)

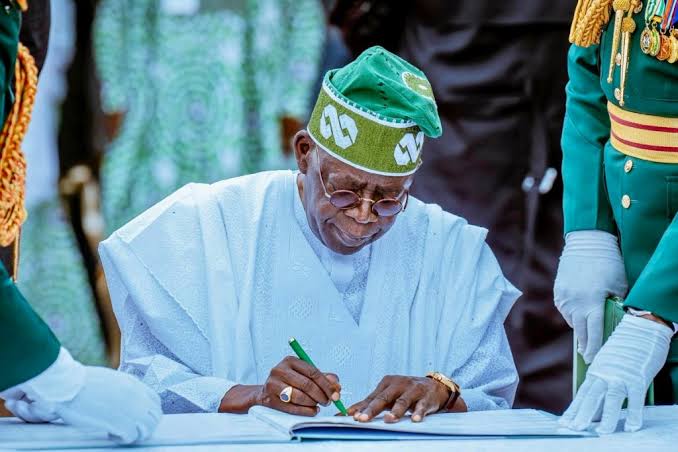

On Oct. 3, President Bola Tinubu transmitted four tax reform bills to the National Assembly.

The bills are the Nigeria Tax Bill 2024, the Nigeria Tax Administration Bill, the Nigeria Revenue Service Establishment Bill, and the Joint Revenue Board Establishment Bill.

They are expected to overhaul tax administration and revenue generation in Nigeria.

The tax reform bills are products of the Taiwo Oyedele-led Presidential Committee on Fiscal Policy and Tax Reforms inaugurated in August 2023, two months after Tinubu’s assumption of office.

From the onset, Tinubu had made it clear that tax reforms were a major focus of his administration, in order to lay a strong fiscal and revenue foundation for sustainable economic growth.

The bills seek to outline all taxes in the country hitherto administered by different laws and compress them into a single law.

They gave the Nigeria Revenue Service, which is expected to succeed Federal Inland Revenue Service (FIRS) powers to collect all national taxes.

However, shortly after the bills were presented to the National Assembly, they started to generate diverse reactions and controversies.

Some argue that the reforms are necessary to modernise the tax system, improve revenue collection, and support economic growth.

They point to the potential benefits of a simplified tax code, reduced tax rates, and increased investment incentives.

However, critics express concerns about potential negative impacts on businesses and individuals.

They argue that the reforms could increase the tax burden on certain sectors, discourage investment, and exacerbate income inequality.

The proposed changes to Value Added Tax (VAT) distribution have also sparked debate, with some regions expressing concerns about potential revenue losses.

The Northern Governors Forum is one group that kicked against the bills.

In a communique read by the forum’s chairman and Governor of Gombe state, Mohammed Yahaya, the governors specifically opposed the proposed amendment to the distribution of VAT to a derivation-based model.

They said that the proposed tax bills were not in the interest of the North and other sub-nationals.

“The Forum notes with dismay the content of the recent tax reform bills that was forwarded to the National Assembly.

“The contents of the bills are against the interests of the North and other sub-nationals, especially the proposed amendment to the distribution of VAT,” he said.

Yahaya said that the forum unanimously rejected the proposed tax amendments and called on members of the National Assembly to oppose any such bill.

He called for equity and fairness in the implementation of all national policies and programmes to ensure that no geopolitical zone is marginalised.

The Borno State Governor, Prof. Babagana Zulum, said that if the reforms passed through the National Assembly, states would be disadvantaged, with Lagos State being the principal beneficiary.

The Bauchi State Governor, Bala Mohammed, also condemned the tax reform bills, saying the policies are anti-North.

Muhammed said that the bills before the National Assembly were aimed at favouring a section of the country to the detriment of Northern Nigeria.

“No policy should be imposed on the people because Nigeria does not operate an oligarchy system of government or a military rule.

“It is not a good policy for Northern Nigeria because we are not going to get money to pay workers’ salaries, to do roads.

“The presidency and the Federal Government must listen to our plights otherwise, they are calling for anarchy, and that is not good,” he said.

Northern senators also called for the suspension of further legislative action on the bills, which have passed second reading in the Senate.

The lawmakers made the demand, citing potential adverse effects on Northern states.

Sen. Ali Ndume (APC, Borno), said that the Northern senators met with their governors and other leaders and agreed to advise for the withdrawal of the tax reform bills for further consultations.

Ndume said that it was in line with the suggestions of traditional rulers and the National Economic Council (NEC), adding that state assemblies in the region would also voice out their objections.

He said that some provisions in the bills clashed with the Nigerian constitution and would not stand.

The controversies around the bills have resulted to delay in them getting legislative attention.

The House of Representatives had earlier suspended debate on the bills due to public outcry and resistance from some Northern lawmakers.

The lawmakers who rejected the bills included 48 members from the North-East, 24 from Kano, and a former Governor of Sokoto State, Senator Aminu Tambuwal, who represents Sokoto South Senatorial District.

The presidency, however, said that the four tax reform bills were not against the interest of the North.

Presidential Spokesman, Mr Bayo Onanuga, said that the reforms were designed to streamline tax administration and promote equitable economic development across the country.

Onanuga refuted claims that the bills recommended the dissolution of key federal agencies, like the National Agency for Science and Engineering Infrastructure (NASENI), Tertiary Education Trust Fund (TETFUND), and National Information Technology Development Agency (NITDA).

“Since the public debate around the transformative tax bills began, various political actors and commentators have tried to obfuscate the facts, deliberately misinforming and misleading the public.

“Unfortunately, most reactions are not grounded in facts, reality, or sufficient knowledge of the bills.

“While some commentators have attempted to incite the people against lawmakers, others have polarised one section of the country against another.

“The tax reform bills will not make Lagos or Rivers more affluent and other parts of the country poorer, as recklessly canvassed,” he said.

According to him, the bills will not destroy the economy of any section of the country.

“Instead, they aim to enhance the quality of life for Nigerians, especially the disadvantaged, who are trying to make a living,” Onanuga said.

Also, the Director-General, National Orientation Agency (NOA), Lanre Issa-Onilu, said that the bills were not to oppress any region in the country.

Issa-Onilu said that they would ensure fiscal discipline and tax harmony, adding that they will harmonise taxation and prevent multiple taxation.

He urged members of the public to access the documents to critically peruse them before making comments in order not to misconstrue the whole essence of the reforms.

According to Uche Uwaleke, a Professor of Capital Market and the President of Capital Market Academics of Nigeria,

the proposed tax reforms represent a welcome development that will boost the capital market.

Uwaleke said that section 56 of the bills proposed a gradual reduction in the income tax on total profits of a company from the current 30 per cent to 27.5 per cent in 2025 and to 25 per cent from 2026.

“This reduction will go a long way in improving shareholders’ wealth and valuation of companies listed on the exchanges.

“In addition, what is considered as the threshold for small companies exempted from income tax has been increased from N20 million per annum, to a maximum gross turnover of N50 million per annum.

“It bears repeating that the reduced income tax rates and other generous incentives to small businesses will most likely spur business activities, and create more job opportunities essential for the growth of the capital market,” he said.

He said that one of the objectives of the bills was to simplify tax administration and reduce the number of taxes from over sixty to a single digit.

He said that this will go a long way in improving the ease of doing business in Nigeria, and will also rub-off positively on the bottom line of listed companies.

“It is pertinent to note that the bills contain a number of tax incentives capable of uplifting the capital market.

“All said, the capital market in Nigeria needs fiscal incentives to gain traction.

” The implementation of the proposed tax reforms, as contained in the tax bills currently before the National Assembly, will help provide the needed elixir for the Nigerian capital market” he said.

As the controversies rage, experts agree that the success of these tax reforms will depend on careful implementation and addressing the concerns of various stakeholders.

They suggest that finding a balance between revenue generation and economic growth will be crucial for their long-term effectiveness.

NANFeatures